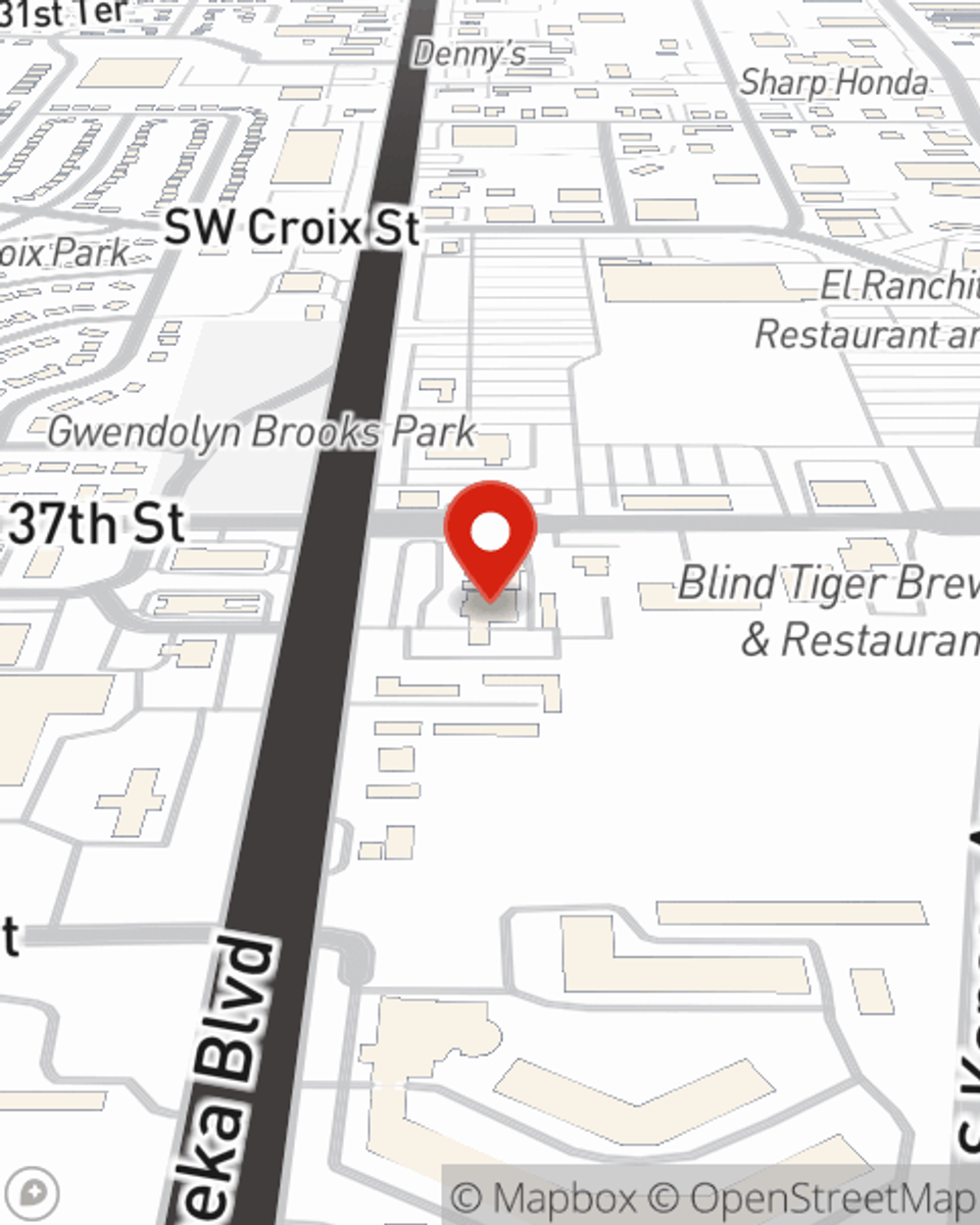

Business Insurance in and around Topeka

Looking for small business insurance coverage?

This small business insurance is not risky

- Topeka, Kansas

- Auburn, Kansas

- Eskridge, Kansas

- Berryton, Kansas

- Tecumseh, Kansas

- Overbrook, Kansas

- Lecompton, Kansas

- Carbondale, Kansas

- Burlingame, Kansas

- Osage City, Kansas

- Lawrence, Kansas

- Scranton, Kansas

- Lyndon, Kansas

- Wamego, Kansas

- Paxico, Kansas

- Emporia, Kansas

- Sedona, Arizona

- Kansas City, Kansas

- Kansas City, MO

- Wichita, Kansas

- Phoenix, Arizona

- Tucson, Arizona

- Missouri

- Arizona

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to take into account. We understand. State Farm agent Jamie Hornbaker is a business owner, too. Let Jamie Hornbaker help you make sure that your business is properly protected. You won't regret it!

Looking for small business insurance coverage?

This small business insurance is not risky

Insurance Designed For Small Business

Whether you are a sporting goods store owner a painter, or you own an advertising agency, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Jamie Hornbaker can help you discover coverage that's right for you and your business. Your business policy can cover things such as money and business liability.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Jamie Hornbaker's team today to discover your options.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Jamie Hornbaker

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.